december child tax credit payment amount

Here are more details on the December payments. And unless Congress decides to extend the monthly payments the final installment will come in December.

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

The amount parents receive depends on the age of the child.

. However if you still havent received any checks or if youre missing money from one of the months. Families will see the direct deposit payments in. The other half.

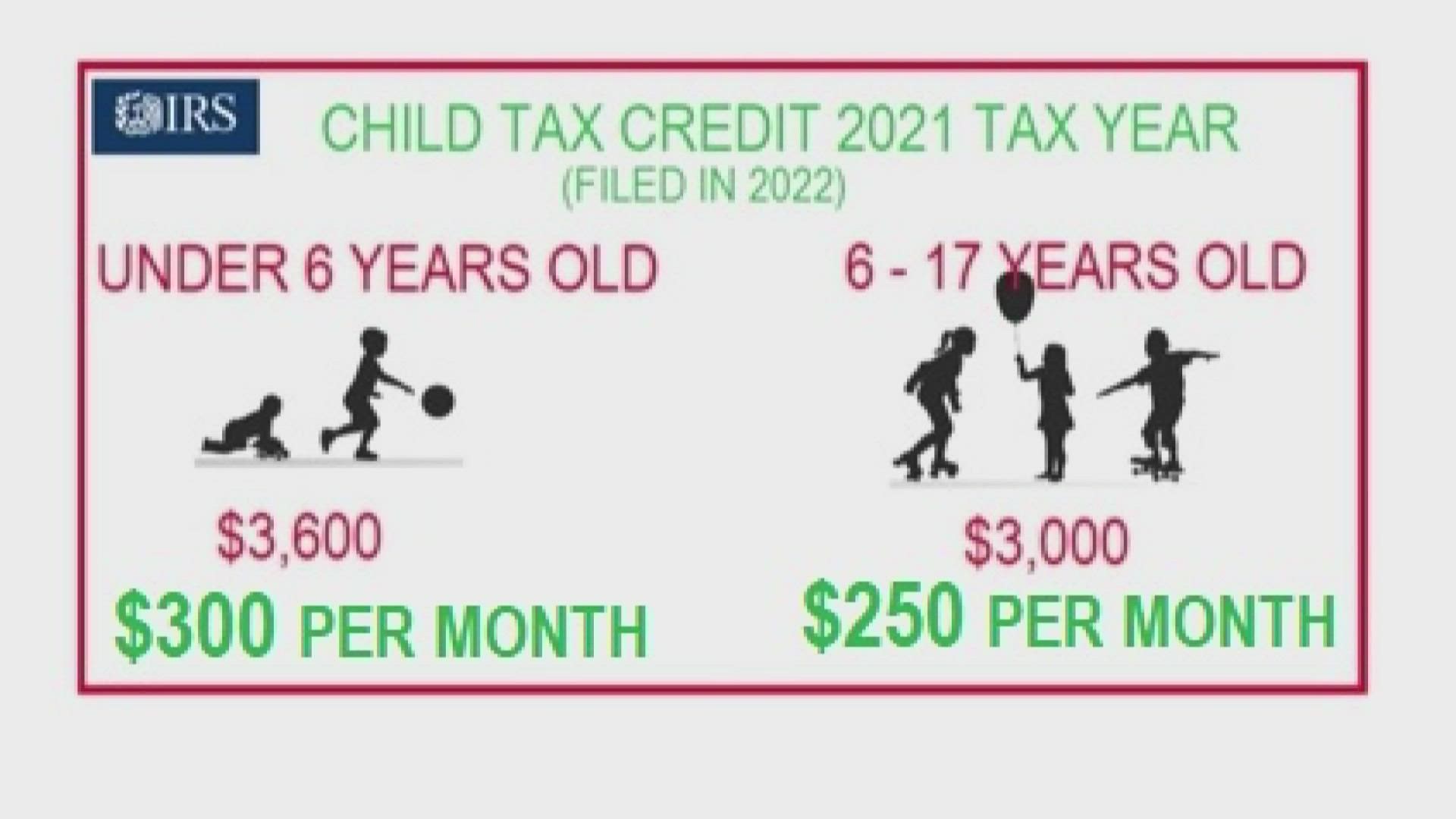

2021 payouts by age. 7 rows The IRS bases your childs eligibility on their age on Dec. Qualified children ages five and under may count for up to 3600 up to 300 per month from July through December.

The monthly child tax credit payments have come to an end but more money is coming next year. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. How much is the child tax credit worth. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

The payment for children. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

It also provided monthly payments from July of 2021 to December of 2021. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child. However theyre automatically issued as monthly advance payments between July and December -.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17 years old. If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the amount of your 2021 Child Tax Credit based on information shown on your 2019 tax return including information you entered into the Non-Filer tool on IRSgov in 2020.

For the 2021 tax year only the child tax credit has been raised from the original 2000 child tax credit which was only sent for children age 16 or younger. Typically the child tax credit provides up to 300 per month for each child under age 6. The next child tax credit check goes out Monday November 15.

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. When you file your 2021 tax return you can claim the other half of the total CTC. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021 instead of waiting until tax filing season to receive all of.

Learn more about the Advance Child Tax Credit. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

When you file your taxes for 2021 in 2022 you will receive the other half of the benefit. Your amount changes based on the age of your children. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

The maximum CTC payment currently stands at 300 dollars per month for each qualifying child under the age of six years and 250 dollars per month for each child between the ages of six and 17. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. For parents with children 6-17 the payment for December will be 250.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint. For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. What happens to the CTC after December.

Reporting income changes using the Child Tax Credit Update Portal can help people make sure they get the correct amount of advance child tax credit payments during 2021 especially people who want. The Child Tax Credit helps all families succeed. 31 2021 so a 5-year-old turning 6 in.

Families with children between 6 to 17 can claim the full amount of 3000 per child if they didnt get any monthly payments. For many families the credit then plateaus at 2000 per child and starts to phase out for single parents earning more than 200000.

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Monthly Child Tax Credit Checks Begin Arriving For Washington Families In July Ymca Of Greater Seattle

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

The Child Tax Credit Toolkit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca